From a financial and lifestyle point of view, it’s great to be part of the Landlord Nation trend, as coined by Redfin and detailed in this article from Bloomberg. Landlord nation is a growing group of mom-and-pop investors who are capitalizing on low mortgage rates and strong rent growth to redirect savings into rental properties. The engine for landlord nation is the huge population of millennials who continue to delay the purchase of their first home and choose to rent over living in their parents’ basement.

From a financial and lifestyle point of view, it’s great to be part of the Landlord Nation trend, as coined by Redfin and detailed in this article from Bloomberg. Landlord nation is a growing group of mom-and-pop investors who are capitalizing on low mortgage rates and strong rent growth to redirect savings into rental properties. The engine for landlord nation is the huge population of millennials who continue to delay the purchase of their first home and choose to rent over living in their parents’ basement.

It’s no surprise that the millennial generation is helping Denver grow; the city’s appeal to younger residents has been well documented. Now, the New York Times chimes in with its assessment of the city’s appeal to millennials.

In a special “Cities” section in the newspaper’s July 21 print edition, it’s reported that Denver appeals to millennials for more reasons that its beer, mass transit, mountains and legal marijuana. Denver “has risen from economic stagnation and urban irrelevance to become a millennial magnet,” the Times reported, adding “one obvious reason is the economy: the city is healthy — and hiring.” An analysis of census data by Zillow, found that 18- to 34-year-olds accounted for 35 percent of the city’s population growth from 2010 to 2014, up from 26 percent in the first 10 years of the century.

In March, Denver was rated the best place to live in the country by U.S. News and World Report and last month, Denver was ranked high by millennials as a great place to live.

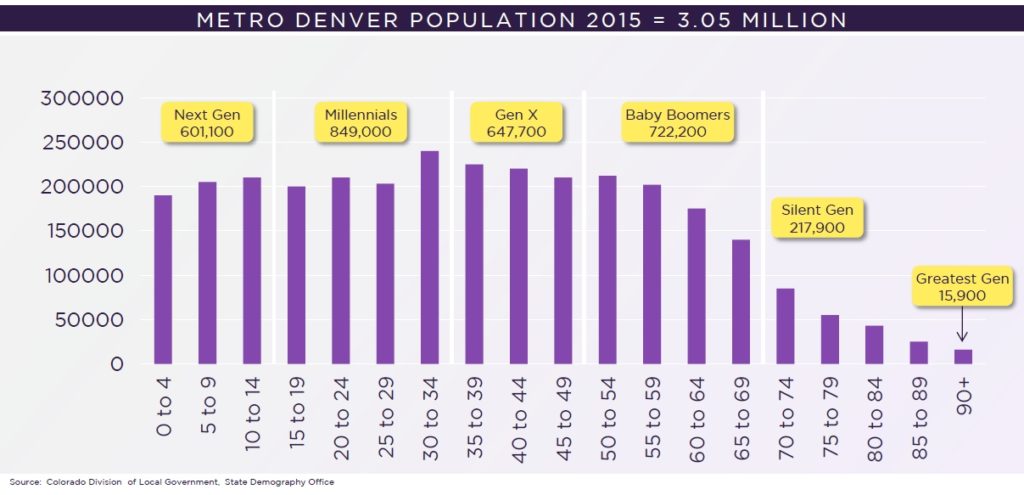

The population of metro Denver will grow from 3.0 million (2015) to 3.5 million (2025). Millennials continue to be the largest generational segment in Denver. 36% of millennials currently live with their parents. This will drive a lot of household growth as they move out.

Why This Matters:

- It is easier to be a landlord now than it has ever been in the history of the U.S.

- The number of starter homes on the market dropped by more than 44 percent from the first quarter of 2012 to the first quarter of this year.

- With entry-level homes in short supply, median prices in the category increased by nearly a third.

- The share of single-family homes used as rental properties, meanwhile, has surged to a 30-year high.

- Separate data provided by RealtyTrac show that only 65 percent of homes purchased in 2015 are owner-occupied.

- The share of U.S. households that rent is at its highest level since 1965